Instead of collecting checks using the mail, collect payments using online fund transfer applications. Online fund transfer applications reduce wait time compared to postal mail, are more secure, and also protect your privacy. Some of the benefits of these applications are:

- Services are available free of charge*

- Accounts are accessible at any time

- Automatic digital tracking for payments using the application versus making paper copies of checks or scanning checks into a computer

- Best of all, payments can be collected and transferred into a bank account without giving away any private information like an address

Open the app after downloading it and start the setup process:

- Create an account by entering an email address and creating a password. Be sure to use a sophisticated password for this account since it will attach to a bank account.

- Add a new bank account. Choose a bank from the pre-populated list or click "Other" to manually add in the bank's routing number and your account number. These can be found at the bottom of a check. To find these settings later, click the menu button in the upper left corner, select Settings, then select "Banks & Cards".

- Click Save to save the new bank account.

- Click the icon in the upper right corner with the dollar sign to request a payment.

- Type in a name of someone in contacts, a Venmo @username, phone or email address to request a payment.

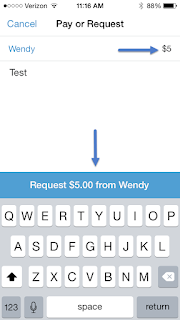

- At the Pay or Request screen, type in the amount of the request. In the body of the screen type out an explanation for the request.

- In the middle of the screen above the keyboard, click the Request button.

- To send the request click the blue banner showing the request amount and recipient.

- Click on the single person icon in the top banner of the home page to see the status of all previous payment requests and bank transfers.

- Incomplete requests and payments can be accessed by clicking the menu button in the upper left corner, and selecting "Incomplete".

- Click the menu button in the upper left corner and select "Transfer to Bank".

- Type in the amount to transfer, the amount available to transfer appears on the right as "Your Balance".

- Verify the correct bank account is selected and select "Transfer to bank" at the bottom of the screen.

Whatever the reason for collecting payments, payments made using online fund transfer applications create requests quickly, process transactions faster than waiting for postal mail, save a trip to the bank and protect your identity and privacy. For anyone only requesting payments, as in the example of requesting rent, utilizing an application like Venmo is a great fit because it does not impose any fees for collecting funds. Once an account is set up, the process consists only of requesting a payment and transferring funds to a bank account after the funds have been paid. NOTE: Unlike some fund transfer applications, Venmo does not automatically transfer received funds into a bank account so you must remember to check and transfer funds after requesting a payment.

*Note: Every online fund transfer application who processes payments operates differently. Some impose fees on to the customer who pays the transaction, while others take a percentage of the payment before transferring the remainder to the payment requester. Be sure to read the FAQ of any online payment system and make sure you understand how it operates before signing up and using it.

Enjoy this post? Subscribe to our Blog

Great post on Online payment app. I am looking for these kind of post.It's provide me useful information.

ReplyDeleteMarrakash

ReplyDeleteImpressive posting, really liked reading it. I like your writing style, it’s quite unique. Thanks for sharing the information here.

Fort Mcmurray landlords

Rent faster

Thank you Zahidul, we are thrilled you found the information helpful!

ReplyDeleteThank you for sharing this app, it is very interesting. I would like to recomend you a similar one: Verse App. You can pay your friends by mobile.

ReplyDeleteThanks for the information Sofia, I see that app is only available in Europe right now but good information!

ReplyDelete